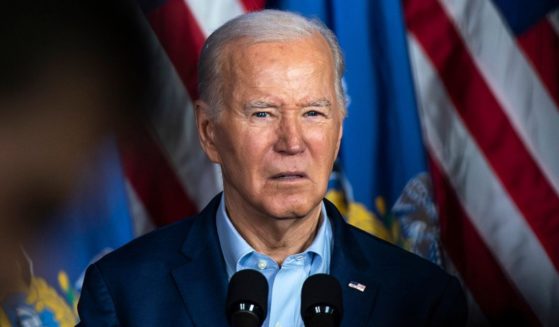

As Oil Hits Over $100 Per Barrel, Biden Halts Oil and Gas Leasing on Federal Land

While oil prices rise due to Russia’s invasion of Ukraine, the Biden administration is delaying new federal oil and gas leases.

This comes in the midst of rising frustration from Americans over increasing gas prices. In the U.S., gas prices are averaging more than $3.50 per gallon, NPR reported. These are the highest averages seen since 2014.

The halt in federal oil and gas leases is Biden’s response to a court ruling that blocked the administration’s attempt to emphasize potential damage from greenhouse gas emissions when creating rules for polluting industries, the Associated Press reported.

On Feb. 11, U.S. District Judge James Cain of the Western District of Louisiana issued an injunction that bars the Biden administration from using a higher cost estimate, which would have put a higher monetary value on the damages caused by every extra ton of greenhouse gases emitted, the AP reported.

Cain’s decision sided with Republican attorneys general from several energy-producing states, who argued that the administration’s desire the raise the cost estimate for carbon emissions would drive up overall energy costs. But while it drove up costs, it would decrease state revenues from energy production.

“The … estimates artificially increase the cost estimates of lease sales, which in effect, reduces the number of parcels being leased, resulting in the States receiving less in bonus bids, ground rents, and production royalties,” Cain wrote in his decision, The Hill reported.

In response to this ruling, Biden’s administration is halting decisions on new oil and gas drilling on federal land as multiple departments revise rules and regulatory analyses to align with the ruling.

This delay on federal leasing most immediately affects oil and gas lease sales that had already been planned on public lands in several states, including Wyoming, Montana and Utah, the AP reported.

This is particularly aggravating for many Americans and party Republicans, because leasing federal lands for oil and gas drilling is one of the main ways that the U.S. can sustain and build energy independence.

At this particular moment, as the Russia-Ukraine conflict is directly impacting U.S. gas prices, American energy independence is more attractive than ever.

“Even in the face of a global energy crisis, historic inflation and skyrocketing gasoline prices, the Biden administration continues to crush U.S. energy production,” Republican Sen. John Barrasso of Wyoming said, the AP reported. Barasso is a top Republican on the Senate Energy Committee.

Oil costs have surged to over $105 per barrel in response to Russia’s invasion. Some Wall Street analysts are predicting that the price could go as high as $150, NPR reported.

Since Russia is one of the world’s top oil contributors, along with the U.S. and Arab countries, its tensions with Ukraine and the West are directly tampering with the oil market.

Russia supplies almost all of Europe with oil. If Russia cuts off that supply, it could seriously damage the global oil and gas market.

“Should we actually have Russian oil supplies cut off to Europe, which is 3 million barrels a day, we could see oil prices rise another $10 to $15 a barrel, putting Brent at about $110 a barrel,” Andy Lipow, president of Lipow Oil Associates, told CNBC News.

To mitigate this, other oil-producing countries will basically have to decide how to keep enough oil on the market to meet demands.

The Wall Street Journal reported that the International Energy Agency said that has been watching Russia with growing concern.

“It said it was working with member countries—which include the U.S. but not Russia or Saudi Arabia—and partners to ensure there was enough oil on the market to meet demand,” the Journal reported.

This is why gas prices in the U.S. are high.

Now Biden’s decision to halt federal leases for domestic oil and gas drilling has the potential to hurt gas prices even more.

It’s predictable that Biden would want to halt domestic drilling on federal lands, since he promised to fight climate change and leasing federal lands for fossil fuel development would conflict with that policy.

“These fossil fuel projects are incompatible with Biden’s goal of avoiding 1.5 degrees Celsius of warming and they need to be canceled, as Biden promised to do,” Taylor McKinnon from the Center for Biological Diversity said, the AP reported.

However, Biden is also fully aware of how the Russia-Ukraine crisis is hurting oil prices.

In the midst of a fluctuating oil market that is directly hurting American pockets, Biden is halting federal drilling leases, which hurts American energy independence and keeps our gas prices tied to international tensions.

Truth and Accuracy

We are committed to truth and accuracy in all of our journalism. Read our editorial standards.