What Does the U.S. Economy Hold in Store for the Second Half of 2021?

Today is the last day of the first half of the year, and for many, it is time to take financial stock.

If you invested $10,000 in the S&P 500 at the beginning of the year, you would have earned around $1,500, or if you stuck it into the Dow Jones Industrial Average, you would have made $1,200.

This 12-to-15 percent return is pretty impressive considering even the best bank savings accounts only offer around half of one percent on average.

But what will the economy look like in the next six months? There are several troubling factors.

First Up, Inflation

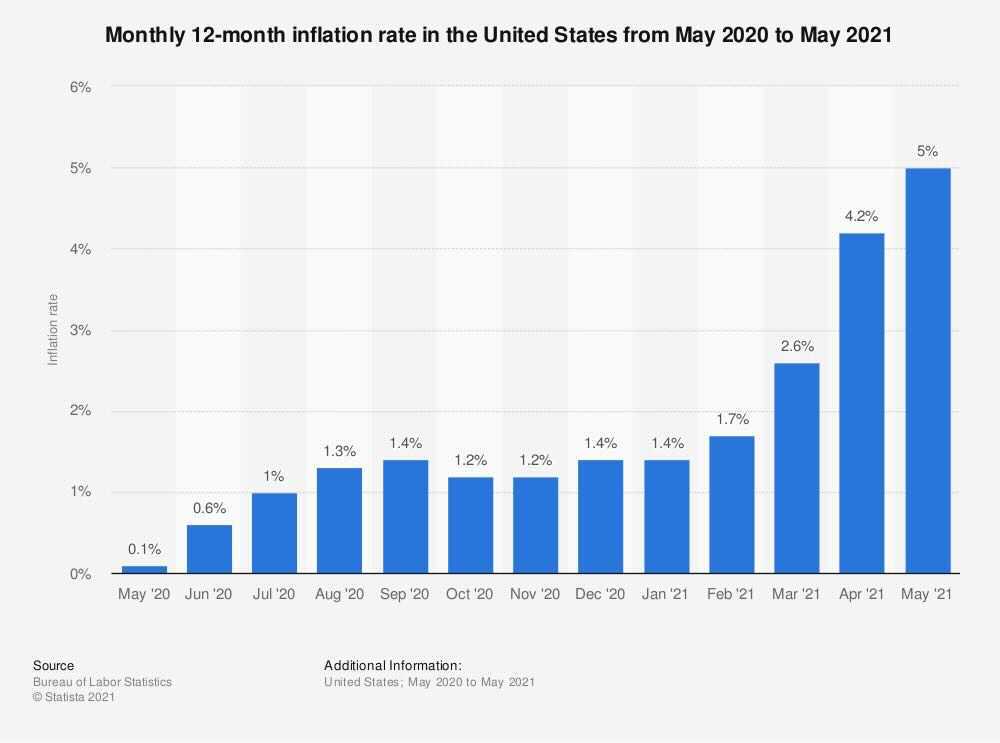

May rocketed up the annual inflation rate to a 13-year high of five percent, with a key indicator — the “all items index” — exploding to levels not seen since 1992.

More disturbing is the producer price index, which measures the prices manufacturers and companies pay in producing consumer goods and services. It is often used as a future indicator of retail prices.

If companies are paying higher prices today, they likely will pass those costs onto the consumer tomorrow.

In May, the PPI hit 6.6 percent — the highest on record.

Both the momentum of increased prices and future indicators strongly suggest higher prices will be with us for a while.

And that’s especially true of housing prices.

Home Prices Highest on Record, But That May Change Soon

Realtor.com reported May’s housing numbers showed median home prices rocketing to a whopping $380,000 — the highest on record — and CNN reported year-over-year price gains have lasted 111 straight months.

The last time housing prices dropped was back in 2012. According to real estate broker Redfin, more than half of homes sold for above list price in May — the first time that has ever happened.

But, there’s a dark side to these red-hot values: foreclosure moratoriums coming to an end. Although home inventory numbers are at a historic low — only about half a million homes listed for sale nationwide, less than half of last year’s inventory — that may very well change once the foreclosure moratoriums are lifted.

Mortgage analyst Black Knight counted 2.5 million mortgages that are currently delinquent. But these homeowners are now protected by the federal foreclosure moratorium, which was extended by President Joe Biden in February and has created a logjam by preventing banks from seizing homes.

Once these homes are foreclosed upon and placed on the market, the sudden increase in supply could very well cause a crash in prices.

That is especially true when considering that construction has picked up as more workers rejoin the labor force and the prices of materials have dropped. Lumber prices, for example, which peaked at almost $1,700 per thousand board feet last month, plummeted to $713 on Tuesday.

The Biden Administration Puts Its Fingers in Its Ears

Despite presiding over the worst inflation, by some measures, since 1992, Biden has said very little to address the legitimate concerns of Americans.

The Hill reported that “Biden administration officials are insisting that the recent inflation spike will be temporary.”

Federal Reserve Chair Jerome Powell still believes inflation is a long way off, despite the unambiguous numbers.

“We will not raise interest rates preemptively because we fear the possible onset of inflation,” Powell said Tuesday during a Congressional hearing, according to Reuters.

“We will wait for evidence of actual inflation or other imbalances.”

All Bets Are Off

Clearly, now is not the time to buy a house, or really, with inflation numbers being this high, make any large purchase.

With a 28 trillion dollar debt, near-zero interest rates and no intention to even try to rein in federal spending, inflation may be Biden’s only solution, which would be devastating to millions of people’s real income and retirement savings.

Biden may be trying to sell the benefits of inflation to reduce the debt, student loans and sky-high mortgages.

What is the average American to do?

Invest.

Investing in the stock market has historically been the best way for individuals to combat inflation. One could do a lot worse than to put money into a plain, vanilla S&P 500 index fund.

Truth and Accuracy

We are committed to truth and accuracy in all of our journalism. Read our editorial standards.