Dick Morris: Deficit Matters, but Only a Little

Congress is about to tie itself in knots and relitigate its favorite battle — the drive to rein in spending and hold down the deficit.

Now let the circus begin!

All the usual elements are there:

• Republicans who want to break the sequester caps for more defense spending.

• Democrats who insist on raising discretionary domestic spending in tandem with military increases.

• Experts who want to hold down the deficit.

• Alarmists who worry that a deadlock might delay raising the debt limit.

• Congressional leadership that wants to appear responsible, and a president who has yet to reveal his agenda.

Just like always.

But let’s step back and ask the heretical question: How much do deficits really matter?

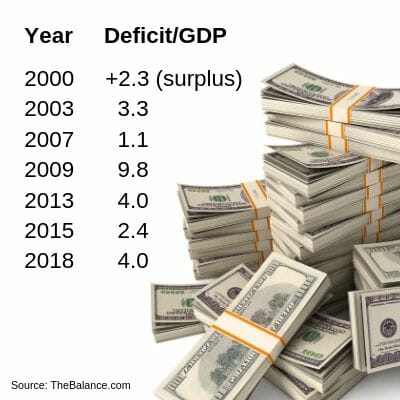

The chart below gives the annual ratio of deficit to gross domestic product:

From 2000 to 2007, as we rebounded from 9/11, the deficit was held in check. It didn’t matter. The economy crashed anyway.

Then, responding to the crash and trying to keep body and soul together, President Barack Obama rained down stimulus money and the deficit-to-GDP ratio rose to nearly 10 percent.

Then the ship stabilized and that figure shrank back down to the 2 to 4 percent range, where its been ever since.

We need to hold down the deficit largely because our past indebtedness is so great — a national debt of over $22 trillion — that any increase in interest rates can destroy our economy.

If rates were, for example, to go up 2 points — 200 basis points — it would cost more than $400 billion more in debt service, or about 2/3 of our total annual defense spending.

With this price tag on rising rates, the Fed works overtime to avoid it. Should inflation reappear, this could tie our hands in fighting it. No more Paul Volcker choking inflation with massive interest rate hikes.

There is also some evidence that this amount of public borrowing forecloses small and other businesses from borrowing for job creation and crowds them out at the lending window.

These harms are real enough, but don’t go nuts. This level of deficit-to-GDP is roughly normal, given our times, and not likely to drag the nation to despair and ruin.

So watch the deficit games unfold, but don’t worry that our national survival is at stake.

The views expressed in this opinion article are those of their author and are not necessarily either shared or endorsed by the owners of this website. If you are interested in contributing an Op-Ed to The Western Journal, you can learn about our submission guidelines and process here.

Truth and Accuracy

We are committed to truth and accuracy in all of our journalism. Read our editorial standards.

Advertise with The Western Journal and reach millions of highly engaged readers, while supporting our work. Advertise Today.