CNBC Personal Finance Column Offers Offensive 'Upside' to Biden's Inflation

What a difference a few hours — and a bit of social media ignominy — can make.

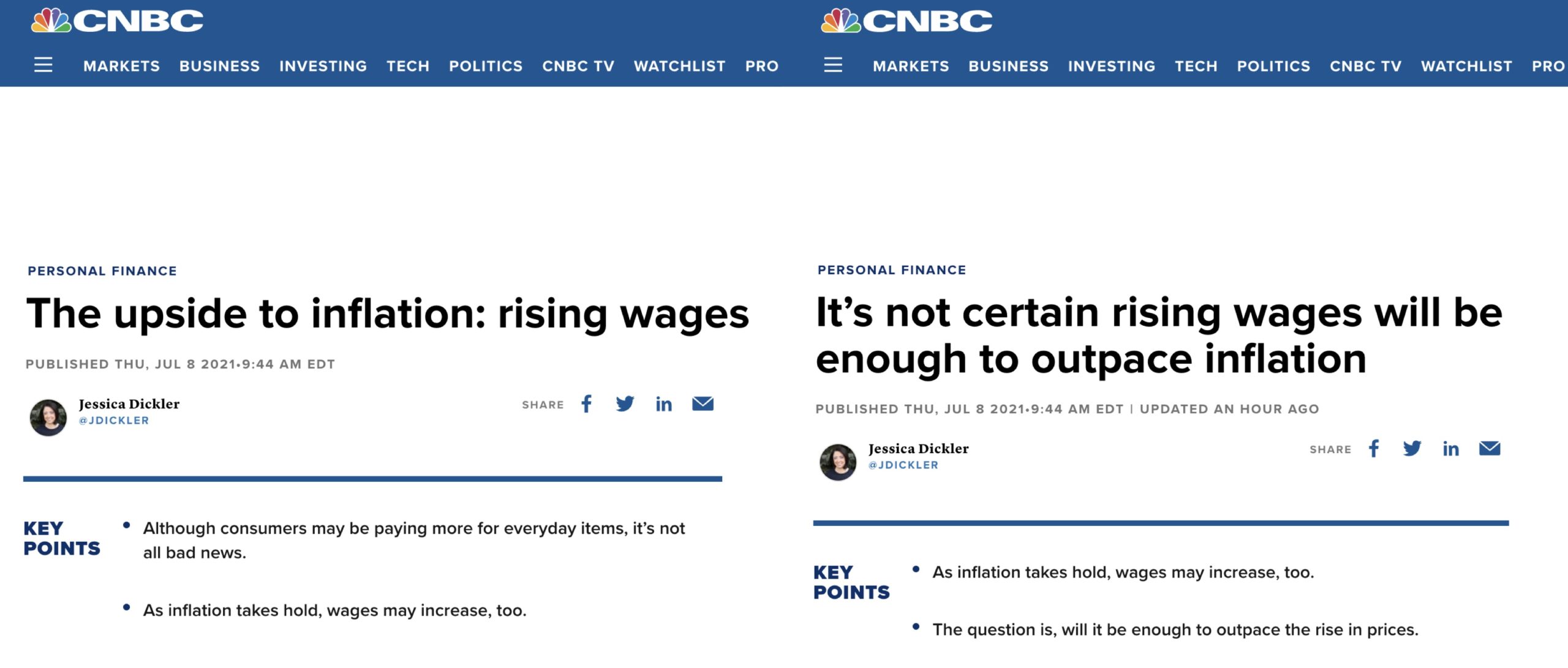

If you went to CNBC’s website Thursday afternoon, you might be wondering what all the hubbub was over Jessica Dickler’s personal finance column on buying power under the Biden administration. The headline: “It’s not certain rising wages will be enough to outpace inflation.”

“As the economy picks up in the wake of the COVID pandemic, concerns about inflation are also gaining steam,” the piece read. “Already, prices on some goods, like cars, are noticeably higher, stoking fears that a sudden uptick in inflation will decrease purchasing power over time.”

However, Dickler also noted that while “consumers may pay more for everyday items, companies facing a labor shortage are also paying more to get workers to walk in the door.”

“Workers already saw a bump in their paychecks for June,” she wrote. “As of the latest tally, average hourly earnings rose 0.3% month over month and 3.6% year over year, according to the Labor Department.”

You may be wondering what the big deal was. Alas, you got there a few hours too late. The unvarnished original is on the left, the airbrushed version is on the right:

You know, Jimmy Carter got such a bad rap. If we’d given him long enough, we’d eventually have seen the upside of inflation: higher wages!

While the original version of Dickler’s story isn’t up, the initial tweet linking to it is, and it’s just as tin-eared as the first headline sounded.

Inflation’s silver lining: higher salaries https://t.co/DmXuzKlX8z

— CNBC (@CNBC) July 8, 2021

CNBC sent out a second tweet more in line the new, more sober headline to the piece — which, according to an archived version of the page, was added a few hours later:

It’s not certain rising wages will be enough to outpace inflation https://t.co/lkGYQjzKUA

— CNBC (@CNBC) July 8, 2021

What’s incredible is that not only is the headline more realistic, it’s also more fitting. Not a single word had to be changed for it to work — which should have tipped CNBC off to the fact that, even by the obsequious standards of NBC, their treatment of one of the major issues facing President Joe Biden’s administration was far too Pollyanna-ish.

The piece noted that “incremental wage increases are unlikely to keep pace as the cost of living rises, cautioned David Weliver, founder of personal finance site Money Under 30.”

“There’s going to be a lag,” Weliver told CNBC. “The prices at the gas pump or grocery store may change very quickly but you might not get that raise for a year.”

And then there’s the problem, as Dickler noted, that “some economists fear a too-rapid increase in wages could prompt companies to raise prices and create the very phenomenon of inflation, causing more harm than good.”

The piece closed with a quote by Biden, who “has rejected this view.”

“A lot of companies have done extremely well in this crisis, and good for them,” the president said in May.

“The simple fact is, though, corporate profits are the highest they’ve been in decades,” he added. “Workers’ pay is at the lowest it’s been in 70 years.

“We have more than ample room to raise worker pay without raising customer prices.”

It’s good that the president thinks so, although economic reality and Biden aren’t usually on speaking terms. Consumer prices in May were 5 percent higher than they were a year ago, according to Labor Department data; as The Wall Street Journal noted, that’s the highest inflation number in 13 years.

Moreover, the Core Price Index — which excludes food and energy costs, which can be volatile — was up 3.8 percent, the highest monthly number in almost 29 years.

So, no, the 3.6 increase in wages isn’t going to compensate for the five percent inflation. Furthermore, once federal enhanced unemployment benefits expire, salary growth likely won’t keep pace; keep in mind that employers at the low end of wage pool aren’t just competing against each other, they’ve also been competing against the government dole. Add that to the fact that the Bank of America sees inflation elevated for two to four years, according to Reuters.

The article also leaves out the biggest downside of inflation, particularly for those who aren’t earning wages or who won’t be earning them much longer. For retirees or those about to retire, an inflation bomb would devastate their savings and retirement accounts.

There’s absolutely no upside there — unless, of course, you’re a politician looking for a new problem to throw money at. Retirees who can’t make it on Social Security and their savings is an awfully big problem to start heaving shovelfuls of dollars at after a massive spending spree in the opening months of the Biden administration, however, which would make that a difficult pill to swallow.

My guess is that these ugly realities weren’t why CNBC changed their headline, however. Instead, social media reactions like these had a bit more to do with it:

Tell me you failed economics class but get paid to write about it. https://t.co/bWzOWI6KHE

— Ian Miles Cheong @ stillgray.substack.com (@stillgray) July 8, 2021

NBC admits they don’t understand math https://t.co/dlHbGfBPY3

— Jack Posobiec ?? (@JackPosobiec) July 8, 2021

True. The average monthly salary in Zimbabwe is a whopping 217,000 ZWD.

— ???????? (@Yakovolf) July 8, 2021

Tell me you dont know how economics work without telling me you dont know how economics work: https://t.co/sMYCGgJ37r

— Lauren Chen (@TheLaurenChen) July 9, 2021

We’re reaching North Korean levels of propaganda here… https://t.co/micRaPl9GN

— Amy Tarkanian (@MrsT106) July 9, 2021

The System doesn’t admit errors. In fact, The System is so confident in its power that it will take huge errors and treat them as successes. Then shame you if you don’t acknowledge those successes.

This is why we’ve moved into a new era of politics. No more apologies. https://t.co/IVZnXnQdy7

— Jesse Kelly (@JesseKellyDC) July 8, 2021

“For the next article, how about: ‘Earthquake’s silver lining: more construction jobs.”

“Those salaries in Zimbabwe are off the charts!”https://t.co/3blFHufNRJ

— Buck Sexton (@BuckSexton) July 9, 2021

It’s almost as if these people think inflation is a bad thing. Don’t they know they’ll be getting paid more? Not enough to cover the current rate of inflation, but wages will still be higher. It’s almost as if they’re ungrateful for the silver lining here.

Truth and Accuracy

We are committed to truth and accuracy in all of our journalism. Read our editorial standards.